Affordable Flexible Hospital Insurance

Email Us

Insurance is Protection Against Financial Loss

You deserve to get the health insurance you need without a lot of hassle

Most Americans can not afford a $400 emergency.

Unfortunately, too many families are one emergency away from financial loss.

No one insurance plan covers 100% of all costs incurred. With Supplemental Benefits to cover extra unexpected expenses, you have a better chance of maintaining your standard of living.

At no direct cost to you, as the employer you can make sure your employees stay afloat while recovering – they will thank you for it.

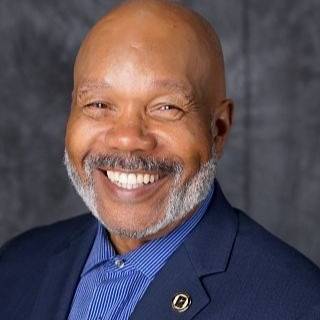

We offer security without stress through Supplemental Benefits (also known as Voluntary Benefits or Worksite Benefits). Alvin Lynn has what you're looking for.

We offer:

✓ Affordable insurance plans

✓ Customized solutions for employees and their families

✓ Professional and courteous customer service

Schedule an appointment with Alvin Lynn to learn more.

Testimonials

See what people are saying about Alvin Lynn.

Katina J.

Alvin takes the time to carefully educate you on everything so you will make the right decision.

Thanks Alvin.

William B.

I feel really good about my policy with Alvin. I'm glad I had the opportunity to meet Alvin because he cares about his clients.

Michelle M.

Alvin helped my husband and I get into a great insurance. We really appreciated his professionalism and concern for our family needs.

CONTACT US TODAY

Flexible Hospital Insurance

While many insurance plans offered by employers may cover a variety of basic healthcare expenses, most plans don't cover everything. There can be gaps in plans that do not pay benefits for hospital stays or high deductible plans that require more money out-of-pocket before the benefits start.

This covers expenses related to hospital admissions, whether its related to an emergency or other reasons.

One day in the hospital could cost you as much as--or more--than a month's rent or a house note. In fact, a recent study shows that the average cost of a one day hospital stay will cost about $2,271. Even with insurance, you could end up paying about $1,000 from your own pocket for things like co-pays, coinsurance, deductibles and other expenses insurance doesn't cover. Are you prepared for that?

Employer Benefits

+

At no cost to you, you can offer Flexible Hospital Insurance coverage for your employees. Plans are flexible, employees can select a wide range of benefit duration amounts and optional benefits.

Employee Benefits

If you or a loved one was admitted to the hospital and suddenly you were faced with a bill for $1,000 by your health insurance, where would the money come from?

Flexible Hospital Insurance is designed to cover or help pay out-of-pocket costs for being hospitalized in addition to your medical coverage and can give you more of a safety net due to an unplanned hospital stay. It covers hospitalizations due to emergencies as well as hospitalizations due to other reasons such as elective surgeries, diagnostic tests, maternity coverage and more. Benefit payments are paid directly to you.

Call Us to Get Your Questions Answered

CLICK TO CALL

Myth: People who are young and healthy don’t need Flexible Hospital Insurance.

Fact: Injury and illness can strike at any time. While you may be healthy today, you might find yourself in the middle of a medical emergency tomorrow. Flexible Hospital insurance can help copays and deductibles if you suddenly become injured or fall ill.

Myth: I can only buy Flexible Hospital Insurance during open enrollment.

Fact: Actually, you can purchase Flexible Hospital insurance at any time. The best time to purchase it is before you need it.

Myth: Flexible Hospital Insurance is offered as a part of all comprehensive health plans.

Fact: Flexible Hospital Insurance plans are great supplements to health plans. They are offered as an additional benefit to your existing health insurance to cover gaps in coverage like unexpected copays and deductibles.

Who We Are

Alvin Lynn has been providing insurance since 2013.

We are a veteran owned business. I am a retired Army 1st Sergeant (1SG). I have lived my life and believe in "serving". I served my country and to this day, I continue to serve my community and clients providing the best service and products available.

BOOK AN APPOINTMENT

Suite 110-5

Farmington Hills, MI 48336

alvin@holisticic.net

Phone

(248) 633-5255

Appointment Only

No Walkins Please