Does Your Membership Based Association or Organization Offer Guaranteed Issue Insurance with No Health Questions?

Comprehensive Cancer Coverage and Coverage for 29 Specified Diseases, Critical Illness and Whole Life Insurance That Puts Your Members First!

What's Next?

Insurance Your Members and Families Can Use

and 29 specified diseases

when diagnosed

Builds Cash Value you can access while alive

Consider This

2+ Million new cancer cases projected in 2024 for the 1st time ever.

Every 40 seconds, an American will suffer a heart attack.

41% of Adults Report not having Sufficient Life Insurance Coverage. That's an estimated 106 million Americans with inadequate coverage.

Racial disparities in cancer are striking. In fact, the death rate for Black people with prostrate, stomach, and uterine cancer is double that for White people.

Every 40 seconds, someone in the US has a stroke.

44% of American households would experience significant financial difficulties within 6 months.

28% would reach this point within a month or less.

Here's How It Works

- Select the coverage that's right for you and your family.

- If diagnosed with cancer or one of the specified diseases, file a claim.

- You may receive a lump-sum cash benefit via check or direct deposit that you can use however you wish.

- Select a benefit and premium amount to meet your needs.

- If diagnosed with a heart attack or stroke, you file a claim.

- You may receive a lump-sum cash benefit via check or direct deposit that you can use however you wish.

- Select the coverage that's right for you and your family.

- Then if you pass away, your beneficiary files a claim.

- A lump-sum cash benefit payable by direct deposit or check can be used however they wish.

Protects Your Finances

- Protect your checking and savings.

- Don't dip into your retirement accounts

- Don't create additional credit card debt

- Protect your checking and savings.

- Don't dip into your retirement accounts

- Don't create additional credit card debt

- Protect your family legacy from the financial impact of long-term care needs. It pays 100% of the death benefit when diagnosed by a physician.

- Builds cash value you can access while alive.

- Waiver of Premium when totally disabled for 6 mo when verified by a physician.

Meeting Your Needs

- Waiver of premium after 90 days when disabled due to cancer

- Coverage can include your dependents

- Coverage may be continued; refer to your certificate for details.

- Includes coverage for cancer and 29 specified diseases

- Guaranteed Issue coverage without a Pre-Existing Condition Limitation

- Coverage can include your dependents

- Benefits paid regardless of any other medical or disability plan coverage

- Coverage may be continued; refer to your certificate for details

- Guarantee Issue Whole Life Insurance with Long Term Care benefit

- Affordable premiums

- Spouse and children may be covered

- Death Benefit paid tax free to beneficiary upon death

Guaranteed Issue Insurance

for Membership Associations and Organizations

We are celebrating our newest Partner Association,

the Amazing Woman Network, now offering

Guaranteed Issue Insurance with no Health Questions

LEARN MORE

Watch for more information

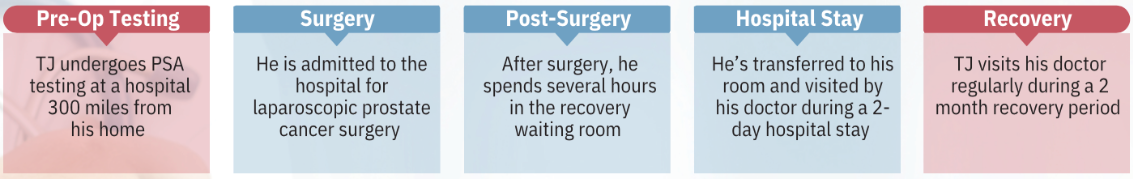

Meet TJ

TJ purchased Cancer Insurance through his membership Association.

A few months later, he is diagnosed with prostate cancer.

Here Is His Treatment Path:

CLAIM

TJ files a claim on his Cancer Insurance coverage. He receives cash benefits for:

- Cancer Initial diagnosis

- Continuous Hospital Confinement

- Non-Local Transportation

- Surgery

- Anesthesia

- Medical Imaging

- Inpatient Drugs and Medicine

- Physician's Attendance

- Anti-Nausea

Here are some of the ways TJ can use his cash benefits

Finances

Can help protect HSAs, savings, retirement plans and 401(k)s from being depleted

Travel

Can help pay for expenses while receiving treatment in another city

Home

Can help pay the mortgage, continue rental payments or home repairs for after care

Expenses

Can help pay for his family's living expenses, such as bills, electricity and gas

3 Compelling Reasons to Consider Guaranteed Issue Insurance for Your Association or Organization Members

By offering Guaranteed Issue Insurance, your association can further enhance the value proposition for its members. Guaranteed Issue Insurance coverage can help differentiate your association from competitors and increase member satisfaction. Members are more likely to renew their memberships and remain engaged with the association.

2. Financial Protection and Peace of Mind:

Guaranteed Issue Insurance can provide important financial protection and peace of mind for association members and their families. This type of insurance can help cover costs that may not be fully addressed by primary insurance policies, such as out-of-pocket expenses, deductibles, or non-covered services. This ensures that members have access to necessary care while protecting their savings and retirement.

3. Exclusive Discounts and Savings:

As a Membership-based Association, you would have the ability to offer your members and their families Guaranteed Issue Insurance at preferential rates. This adds unique value to the membership and helps members save money on essential insurance coverage.

Summary

Many of us know someone who has or is currently fighting cancer. There are approximately 2 million new cases reported per year. That's about 5,480 new diagnoses every day. That is not to mention individuals and families impacted by heart attack, stroke, and the two dozen other illnesses that our offering covers.

On top of that, some people have had a hard time getting life insurance due to preexisting conditions. Have your members experienced this? By providing Guaranteed Issue Cancer, Heart Attack, Stroke and Whole Life Insurance you can greatly enhance your members lives and finances. Our offering has great rates, will not take more time, effort or liability for you to implement and will help foster loyalty and be an appealing benefit for your current and prospective members.

This Is Why You Should Partner With Us?

Premier Coverage for your members

The Alvin Lynn Team is leading the way by making available a first of its kind, proprietary, all-inclusive service that caters to Associations and Organizations. Our service, from start to finish, provides a seamless experience that delivers exceptional value at every step of the way.

Easy Sign-up and Processing

One of the key advantages of partnering with us is our hassle-free enrollment process for participating members. By streamlining the enrollment procedures, we make it easy for members to sign up and access the benefits offered by the Association, ensuring a smooth and efficient experience for all parties involved with no extra work for the Association or Organization.

No Hidden Fees

Transparency is at the core of our service model. We believe in upfront and honest pricing, with no fees to the Association. This commitment to clarity and fairness builds trust and confidence among our clients, fostering strong and lasting relationships based

on integrity and mutual benefit.

Removing the Risk to You

Our Association clients can rest assured that they are shielded from liability. Our comprehensive approach includes shouldering the responsibility for any potential risks. This allows our clients to focus on their core mission.

We do the Work

We understand the importance of minimizing the workload for Association staff, particularly in areas such as human resources and payroll. By taking on these tasks, we have all-inclusive processes so you do not have additional work on your end when you accept our offer. Your members will receive first class service.

Result: Attract and Retain Members

Our commitment to delivering a superior all-inclusive service that prioritizes efficiency, transparency, and client satisfaction is what sets us apart in the market. We are dedicated to providing unparalleled support to your Association, ensuring that you receive the highest level of service and value every step of the way. And the members receive protection unavailable elsewhere at affordable prices.

The Alvin Lynn Team operates as an independent life and health insurance agency and is veteran owned since 2013.

We are a team of skilled insurance professionals who take pride in offering Guaranteed Issue Insurance with no Health Questions to Membership-Based Associations and Organizations.

Serving as trusted advisors, we have established a benchmark by delivering insurance solutions that cater to the needs of members, their families, and the Associations they belong to.

Protect Your Members' Future