Medicaid and

Long-Term Care

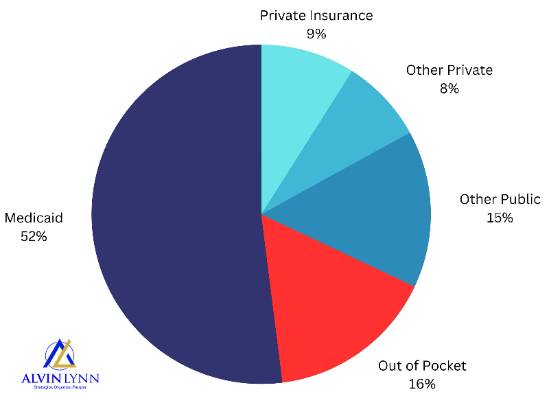

Medicaid is the largest payer of Long-Term Care costs in the U.S. In fact, 52% of residents in skilled nursing facilities are Medicaid recipients.

SCHEDULE A CALL

What is Medicaid and Long-Term Care?

Medicaid is the largest payer of Long-Term Care costs in the U.S. In fact, 52% of residents in skilled nursing facilities are Medicaid recipients. Over half of Medicaid expenditures for Long-Term Care were paid for by home and community based services (HCBS), which include residential care facilities.

To qualify for Medicaid, you must meet income and asset restrictions that vary by state. If you have too many assets to qualify, you may accelerate eligibility by Crisis Planning with a Medicaid Compliant Annuity (MCA).

You don't have to liquidate your hard earned wealth to benefit from Medicaid. Schedule an appointment with Alvin Lynn to learn more.

Our Services

Alvin Lynn offers:

Accident Insurance

Accident Insurance pays a cash benefit to your employee if they or their family sustains a bodily injury like fractures, burns, dislocations and more.

The money is paid directly to the employee to help pay unexpected costs due to an accident or due to injury all at no direct cost to you, the employer.

Cancer Insurance

Cancer Insurance pays your employee a lump sum benefit upon diagnosis of cancer to help cover deductibles, co-pays, transportation for the patient and family members, hotel expenses during treatment, normal living expenses and more all at no direct cost to you, the employer.

Disability Insurance

Your employees depend on their paycheck to support their families and standard of living. Offer Disability Insurance at no direct cost to you, it replaces some of their lost income so they can continue to pay their mortgage, childcare, and other expenses if they suffer a disability and cannot work.

Critical Illness Insurance

Once considered a "supplemental" insurance product, Critical Illness Insurance has become an essential piece of an owner's benefit offering. At no cost to you, the employer, Critical Illness Insurance can provide a real safety net for you and your employees and their families.

Flexible Hospital Insurance

A trip to the hospital for your employees or their families could significantly set back their finances--but you have the ability to lessen that burden. Flexible Hospital Insurance helps to cover out-of-pocket expenses and associated fees for hospital stays at no direct cost to you.

Group Term Life Insurance

Offer your employees financial protection that will travel with them for life--all in a simple package. Group Term Life Insurance is flexible protection that's there for your employees and their families when they need it most.

Click to set up an appointment.

CONTACT US TODAY

CALL US TODAY

What is Medicaid?

* Medicaid is a joint federal and state-funded health insurance program

* In a nursing home, Medicaid pays for a person's custodial care, including room and board, pharmacy, and incidentals.

* Applicants must meet specific criteria to qualify

2 Ways Are Required to Qualify:

Non-Financial and Financial Requirements

1. Non-Finanical Eligibility Requirements

-- Age 65+ or disabled

-- In a Medicaid Qualified nursing home

2a. Financial Requirements: Income

-- Income from all sources must be less than the private pay rate of the facility.

-- Includes Social Security, pension, etc.

Community Spouse

-- If the community spouse's income is below the Monthly Maintenance Needs Allowance (MMNA), they may be entitled to some of the institutionalized spouse's income.

-- No limits on the income of the community spouse.

2b. Financial Requirements: Assets

-- Applicant is allowed to keep $2,000 in countable assets in most states.

Community Spouse

-- Community Spouse is allowed to keep a separate amount knows as the Community Spouse Resource Allowance (CSRA).

-- CSRA varies from state to state, but is typically no more than $123,600.

What Qualifies as a Countable Asset?

Exempt Assets

-- Primary residence

-- One automobile

-- Personal effects and household items

-- Funeral expense trust

Countable Assets

-- Checking/Savings accounts

-- CDs, stocks, bonds

-- Additional real estate or automobiles

-- IRAs

* * * * *

The #1 reason most people don't immediately qualify for Medicaid is they have too many countable assets. And you don't have to liquidate your assets and still qualify for Medicaid when your assets are in a properly structured plan - a Medicaid Compliant Annuity (MCA).

What is a Medicaid Compliant Annuity (MCA)?

A Medicaid Compliant Annuity (MCA) is a Single Premium Immediate Annuity (SPIA) that provides income to the owner and contains zero cash value.

When properly structured, this annuity functions as a spend-down tool that eliminates excess countable assets, allowing the nursing home resident to become eligible for Medicaid benefits.

This is Who Pays for LTC

2. Out of Pocket, Retirement Savings, Investments, Cash-on-Hand

3. Other Public (Medicare and VA)

4. Private Insurance

5. Other Private (Long-Term Care Insurance)

Data: Congressional Research Service

Does ANY Annuity Work?

NoA Medicaid Compliant Annuity is a Single Premium Immediate Annuity (SPIA) with added restrictions to meet the requirements of the Deficit Reduction Act of 2005 (DRA), and it is only offered by a limited number of insurance companies.

What are the Requirements of a Medicaid Compliant Annuity (MCA)?

Irrevocable

The contract cannot be revoked or altered.

Non-assignable

The contract cannot be assigned or sold to another party.

Actuarially Sound

The terms of the annuity cannot exceed an individual's Medicaid life expectancy.

Equal Payments

The contract must provide equal monthly payments with no deferral or balloon payments.

State as beneficiary

In most cases, the state Medicaid agency must be named primary death beneficiary to the extent of benefits paid on behalf of the institutionalized individual.

* * * * * *

An MCA Would Be a Good Choice If You or Your Loved One ...

- Is a resident of a Medicaid-approved facility;

- Is expected to remain at the facility indefinitely;

- Has exhausted all of his or her Medicare benefits;

- Is paying out-of-pocket;

- And has excess countable assets.

What You Need to Know

We provide guidance and design comprehensive Long-Term plans for each unique situation that accelerates eligibility for benefits using a Medicaid Compliant Annuity (MCA).

Disability Insurance

+

If you can't work, your lifestyle is in trouble. Disability insurance is designed to build a hedge of protection around your finances.

Disability Insurance

Cancer Insurance

Accident Insurance

EMAIL US

Myth: People who are young and healthy don’t need worksite benefits.

Fact: Injury and illness can strike at any time. While you may be healthy today, you might find yourself in the middle of a medical emergency tomorrow. With the proper plan you can save money if you are injured or suddenly become ill.

Myth: Worksite benefits are too expensive for employers to provide

Fact: Actually, benefits can be partially-funded or even fully paid for by the employee. That means the company controls how much they spend and what options they choose to add for their employees.

Myth: They don't have enough employees to qualify for worksite benefits.

Fact: It depends on the carrier and product, and many benefits are available to businesses with as little as one employee and some carriers provide for 1099 contractors.

Who We Are

Alvin Lynn has been providing insurance since 2013.

The Alvin Lynn Team are insurance professionals. We specialize in Medicaid Planning, Medicare Planning, Long Term Care Planning and Retirement Solutions Planning. It is our pleasure to collaborate with other trusted advisors outside of our field of expertise to customize a realistic and attainable plan for you. If your goal is to stay retired and not have to return to work because of a lack of money, then understanding and implementing a Holistic Retirement Plan is essential to your overall retirement strategy.

You have a choice to enjoy financial security regardless of market volatility. Our mission is to guide you to financial wellness, by helping you experience freedom from debt a lower tax burden, and a safe and predictable income now and in retirement.

Meet Our Awesome Team

William A.

Write A One To Two Sentence Explanation Of This Feature. Make The Explanation Excite Your Viewer To Take

CLICK TO CALL

Yes, you can. These benefits are available to you as a contractor.

Why do I need Worksite Benefits?

Address

Suite 110-5

Farmington Hills, MI 48336

Phone

Hours by Appointment Only

No walk-ins please

© 2025 Alvin Lynn Brand All Rights Reserved. 25882 Orchard Lake Rd Suite 110-5, Farmington Hills, MI 48336, USA, Farmington Hills, MI 48336. Contact Us. Terms of Service . Privacy Policy